- Charlotte Street Partners

- Apr 24, 2020

- 4 min read

The money tree and the Triffin dilemma

Written by Juan Palenzuela, Associate

Edited by Harriet Moll, Creative Director

Good morning,

Back when I was a student, one of the things that I used to find most surprising about the international monetary system was the fact that despite the trillions that the United States adds every year to its national debt, and despite an ever-increasing budget deficit; investors from around the world are still more than happy to lend America an endless amount of money for meagre returns.

That has only become more surprising over the past weeks. According to the Committee for a Responsible Federal Budget, a Washington-based think tank, America’s national debt is expected to exceed the size of its economy for the first time since World War II due to the pandemic, while the fiscal deficit is expected to grow to nearly $4 trillion (18.7% of GDP) this year, from $984 billion (4.7% of GDP) in 2019 and $585 billion in 2016 (3.2% of GDP) in 2016.

Naive undergraduates could be forgiven for thinking that investors would demand a higher payoff to offset the increased risk of default, but that could not be further from reality: investors are in fact piling in, depressing yields even further. As of April 21, the 30-year US government bond rate was 1.17%, down from 2.33% at the beginning of the year. The 20-year rate was at 0.98%, down from 2.19%.

Thanks to this imbalance, Trump’s government is able to fund huge stimulus packages relatively easily. Perks of being the global hegemon and having a global reserve currency I guess.

Alas, there is a price to pay. Enter the Triffin dilemma, named after an economist with that name: when foreign investors rush to buy dollar-denominated Treasury securities, they appreciate the dollar’s value, making America’s exports less competitive to the rest of the world and driving domestic job losses.

This tradeoff was already awkward before, but now the pandemic will embolden it as investors rush to the safest assets on earth. Immigrants and free trade have in the past been used as the scapegoats of choice for the loss of American jobs and industry, and they will likely continue to be targeted increasingly as a result.

News

Matt Hancock, the health secretary, announced the expansion of the rapid testing programme, including the immediate availability of Covid-19 tests to up to ten million key workers in England. It is part of the plan to get “Britain back on her feet", the secretary explained.

Angela Merkel warned that parts of Germany are leaving coronavirus lockdown too soon, during EU summit talks yesterday. Germany’s regional governments ultimately have the final say over lockdown policy.

Ramadan has started, but this time it will be shaped radically by the crisis. It is normally a sociable time, with adherents abstaining from food and water during daylight hours and meals and gatherings at dusk. This time around, followers will do that by themselves.

Business and economy

Figures released minutes ago by the ONS show an unprecedented surge in food sales growth in March. Sales volumes were 10.4% up, despite the retail sector as a whole falling by 5.1%, the sharpest fall on record.

The French finance minister announced yesterday that his country will bar companies headquartered in tax havens or with subsidiaries benefiting from low-tax regimes from receiving any government aid during the coronavirus crisis.

A new relief bill passed the US’ House of Representatives yesterday which includes a $484bn stimulus package to fund small businesses and hospitals during the crisis. America’s total spending in response to the crisis is now close $3 trillion.

Columns of note

In the Times, Ed Conway ponders if the situation might be the right opportunity to test wealth taxes in a one-off manner.

Tech will emerge stronger than any other sector, but the pandemic will force a reckoning between companies and its workforce, says Richard Waters on the Financial Times.

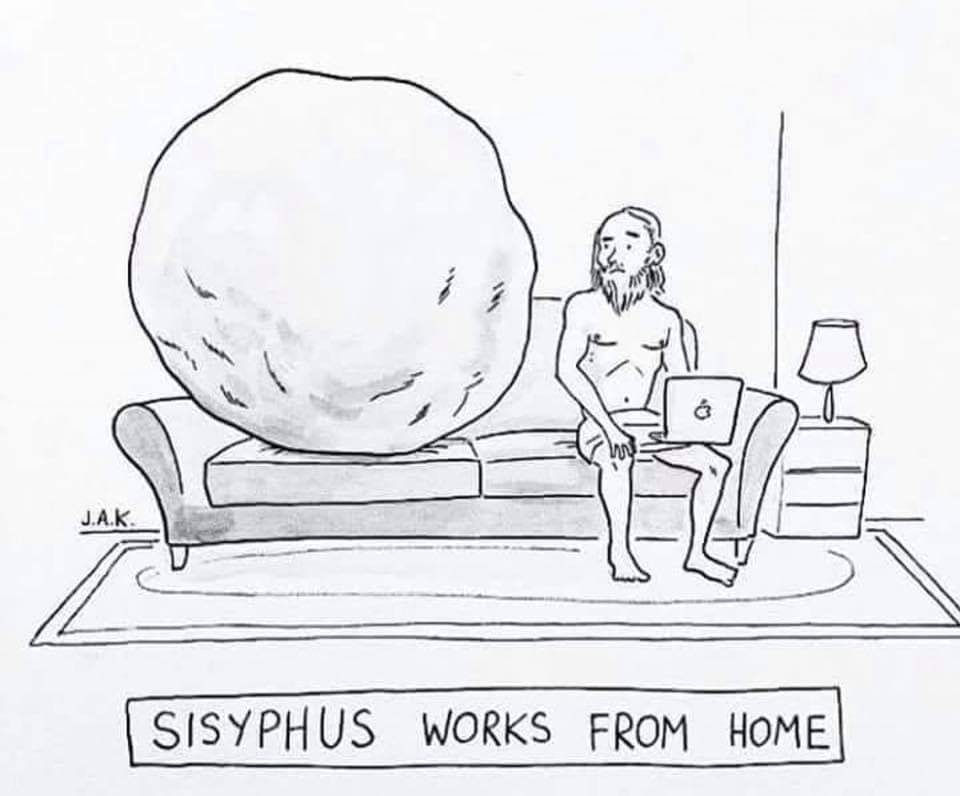

Source: Glenn Marcus

Markets

What happened yesterday?

Equity markets around the globe enjoyed a day of relief thanks to positive announcements regarding the emergence from lockdown in America and Europe. In the US, recovery data was published, while in Europe, active cases of the virus appear to be shrinking.

The Dow Jones Industrial Average was up 0.17% at 23,515.26, while the S&P 500 was 0.05% weaker at 2,797.80 and the Nasdaq Composite saw out of the session 0.01% softer at 8,494.75.

The FTSE100, meanwhile, ended the session up 0.97% at 5,826.61, and the FTSE 250 rose 1.33% to 15,794.04.

The pan-European Stoxx 600 was 0.94% higher to 333.24, alongside a 0.95% rise on the German Dax to 10,513.79 while the FTSE Mibtel added 1.47% to 17,011.11.

On company announcements, CRH, an Irish building material business, approved a dividend payment of nearly €500 million to its investors, highlighting its strong financial position in a statement yesterday.

Aston Martin, meanwhile, said in a statement yesterday that it will follow guidelines from Public Health Wales so it can protect its workforce, as it plans to reopen its Welsh car plant. No specific date has been arranged.

What's happening today?

Finals

Alfa Fin

Nmcn

Serica

Walker Greenbnk

Trading announcements

Science Grp

AGMs

Assetco

ITV

Novolip Regs

O'key Regs

Pearson

Rotork

Senior

St.modwen Prop.

Int. economic announcements

(09:00) IFO Expectations (GER)

(09:00) IFO Business Climate (GER)

(15:00) U. of Michigan Confidence (US)

Did you know?

From the 1950s until the 1970s, vending machines were used at American airports to sell life insurance policies covering death, in the event that the buyer's flight crashed.

Parliamentary highlights

House of Commons

No business scheduled

House of Lords

No business scheduled

Scottish Parliament

Members’ Virtual Question Time

Rural Economy, Environment, Climate Change and Land Reform

Comments