- Charlotte Street Partners

- Mar 31, 2020

- 5 min read

The corona bonds of discord

Written by Javier Maquieira, Associate

Edited by David Gaffney, Partner

Good morning,

It is in tumultuous times like this that European solidarity seems to weaken. For when it comes to European Union politics, it is always complicated.

The latest point of disagreement among EU member states has quite the catchy name: corona bonds – a debt instrument that would raise long-term finance for all eurozone countries to help pay for measures aimed at countering the damage brought by the coronavirus outbreak.

On Thursday last week, as EU heads of state and government joined a virtual summit to agree on their response to the Covid-19 crisis, the Italian and Spanish prime ministers, who are currently dealing with the highest death tolls in the continent, pushed for all eurozone countries to issue these corona bonds. However, the proposal faced resistance from states such as Germany and the Netherlands, with the Dutch prime minister saying that under no circumstances would he agree to common bonds.

The meeting ended with the Italian PM leaving the videoconference without giving support to the leaders’ concluding statement, which tasked eurozone finance ministers with considering formal proposals before returning to the debate in two weeks’ time.

Underlying the Dutch and German opposition is the ongoing perception that southern European countries will never change their ways and just keep on running big budget deficits. This was all the more evident when the Dutch finance minister, Wopke Hoekstra, asked the European Commission to investigate Spain for not having the budgetary margin to tackle the crisis.

In response, Portugal’s prime minister, António Costa, called Hoekstra’s statement “disgusting”and a “recurring meanness” that threatens the future of the EU, as he reminded member states that “it was not Spain that created [nor imported] the virus”. His position was endorsed by France’s Emmanuel Macron, who criticised some countries for acting as though Italy or Spain were responsible for the virus, rather than victims.

In the end, what should have been an opportunity to showcase the bloc’s unity in testing times has brought us back to the starting point of all ideological north-south divisions in the EU: the self-declared moral superiority of northern member states versus the ghost and stigma of conditionality of their southern neighbours.

European integration should not be a project for the good times, since it was one born in the aftermath of the darkest period in modern history. However, like many companies over the last fortnight, the EU is finding that it is easy to say and do the right things when times are good, but harder to stay strong when the chips are down. If the EU is to survive, where there is discord, may we bring solidarity.

News

The foreign secretary announced a £75m plan to bring as many as 60,000 British travellers home following the signature of a memorandum of understanding with airlines, including Virgin, EasyJet, Jet2, and Titan. Dominic Raab said that where commercial flights were not an option, the government will charter special flights to repatriate Britons stranded abroad.

The International Olympic Committee confirmed that the Tokyo Olympics will now open on 23 July 2021, almost a year after the original date. International sports federations gave unanimous support to the new schedule, which will give organisers the time needed to prepare after the disruption caused by the coronavirus outbreak.

Prince Charles ended his seven days of self-isolation after testing positive for Covid-19. According to a palace official, the heir to the throne is in good health, while the Duchess of Cornwall, who tested negative, will self-isolate until the end of the week.

Business and economy

The World Bank expects the Covid-19 pandemic to hit growth in developing economies in East Asia, the Pacific, and China. Although the organisation said that precise forecasts were difficult, its baseline now has growth in those countries slowing to 2.1% in 2020, compared to estimated growth of 5.8% year-on-year. It also recommended countries in the region should invest in healthcare capacity and take targeted fiscal measures.

EasyJet grounded its entire fleet following “unprecedented travel restrictions” imposed by governments across the globe as a result of Covid-19. The budget airline, which had already cancelled most of its flights and had been running repatriation services, said that it could not give a date for when it can restart operations. British Airways has suspended all flights from Gatwick Airport due to the “considerable restrictions and challenging market conditions” telling staff they could expect to hear about any impact on jobs soon.

American Airlines confirmed that it will seek financial support worth $12bn (£9.7bn) from the US government to ease the impact of the coronavirus outbreak. The airline company, which made a $2.9bn profit last year, said the support would mean “no involuntary furloughs or cuts in pay for the next six months”.

Columns of note

Writing in The Times, Hugo Rifkind predicts that the public’s compliance with government advice to protect our health will be severely tested as the horror of this crisis drags into the summer, and officials will struggle to maintain our consent to keep sacrificing our liberties. He expects divisions to arise especially from those going through economic hardship, as well as the young, restless, and bored. (£)

Zoe Williams writes inThe Guardian that with bailouts making a comeback, they should benefit people and not corporations. She argues that the failure that resonates the most from the 2008 financial crisis is that of the social response, and proposes state aid to come with some agile, pro-social conditions - such as maintaining payrolls, keeping people employed, and being headquartered in the UK - to avoid emerging from this period into business as usual practices.

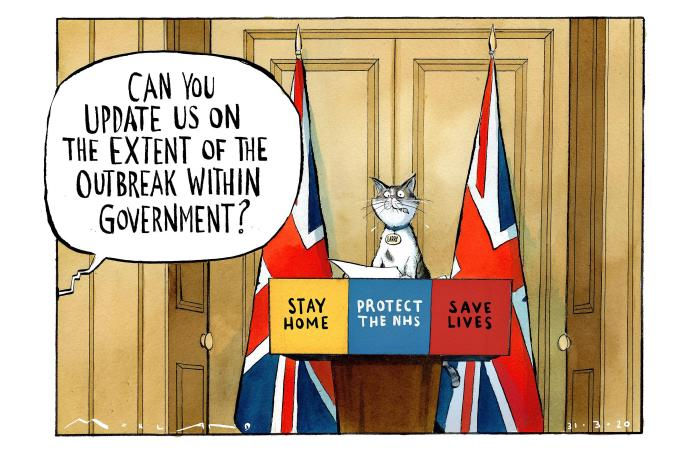

Source: The New Yorker

Markets

What happened yesterday?

London stocks broke into the green by close of play on Monday, with the FTSE 100 ending the session up 0.97% at 5,563.74, while the pound fell 0.62% against the dollar at $1.2383 but was 0.54% firmer on the euro at €1.1242.

Investor sentiment was boosted by Johnson & Johnson’s announcement that it will start human testing of the vaccine as soon as September after finding a lead candidate for the treatment of the coronavirus.

In corporate news, Rolls-Royce (-11.9%) closed in the red following reports that the aerospace and defence engineer was facing a cash flow crisis, while EasyJet (-7.2%) was brought down to earth along with its entire fleet.

On the upside, oil giants BP (+5.92%) and Royal Dutch Shell (+2.55%) closed higher even as oil prices fell to 18-year lows.

In the US, stocks closed sharply higher as the White House extended measures to contain the spread of Covid-19. The Dow Jones saw out of the session 3.19% stronger at 22,327.48, while the Nasdaq Composite was up 3.62% at 7,774.15 and the S&P was 3.35% firmer at 2,626.65.

What's happening today?

Finals Chesnara

Dp Poland

Michelmersh Brick Holdings

One Media

Propty Franchis

Proteome

Surgical Innovations

Tp Grp

Tremor Int Ltd Interims

Diageo

Gfinity

James Halstead

Smiths Group

AGMs

Blue Star

Cloudcoco

Irf Eur (Di)

Toople Plc

UK economic announcements

(00:01) GFK Consumer Confidence

(07:00) Gross Domestic Product

(07:00) Current Account

Int. economic announcements

(08:55) Unemployment Rate (GER)

(14:45) Chicago PMI (US)

(15:00) Consumer Confidence (US)

Did you know?

The first recorded pizza delivery was in 1889 to Queen Margherita of Savoy, who requested a local peasant dish during a visit to Naples. Chef Raffaele Esposito, who delivered the meal, then named the mozzarella, basil, tomato pizza after the Queen: pizza Margherita

Parliamentary highlights

House of Commons

Oral Questions

Ministry of Justice (including topical questions)

House of Lords

No business scheduled

Scottish Parliament

No business scheduled

Comments