- Charlotte Street Partners

- Aug 13, 2020

- 5 min read

Reading the runes for publishing

Written by Ralitsa Bobcheva, researcher

Edited by David Gaffney, associate partner

Good morning,

While lockdown has kept us physically and socially distanced, books - with their immense potential to foster empathy and to bridge the gap between experiences - have continued to bind us closely together.

Worldwide readership has jumped by 33% since March, according to numbers by the Global Web Index Coronavirus Research, with publishers reporting a significant growth in digital book sales particularly.

As welcome and cheering a trend as this would appear to be, these statistics are not the end of the story. While demand for titles has grown in tandem with the size of their audience, publishers across Europe have also reported having to postpone or cancel entirely their plans to introduce a significant number of new titles this year.

In Greece, for instance, title production had dropped by 75% by the end of March and, further north in Bulgaria, publishers expect to share up to 1,000 fewer titles than they had originally planned during 2020. Most strikingly, some 23,200 titles had been cancelled by the end of March in Italy. As well as the financial challenges these figures pose to authors and publishers alike, postponed titles have an invisible long-lasting effect on us all, threatening as it does our cultural diversity by ensuring publishing industry resources are targeted only at the most likely commercial successes.

The impetus for publishing a new title relies principally on two key factors: having the economic capital to do so, and the confidence that the title has a ready - and readily reachable - reading audience. The latter is traditionally stoked and widened via networking events such as book fairs, readings, signing ceremonies, and festivals, most of which have however been cancelled due to Covid-19 restrictions.

And while conglomerate publishers depend greatly on their pre-existing economic capital in order to compensate for the cancellations, small and independent presses rely predominantly on active engagement with their readerships in order to generate profits. Crucially, in terms of multiplicity, it is precisely small presses and self-publishing that present the key pathways to publishing diverse titles. A survey of 72 small UK publishers revealed that nearly 60% expect closure by the autumn, as The Bookseller warns of a “whole tranche of writers” who will not be able to write at all due to financial difficulties or, alternatively, simply won’t see their labours of love published.

An invaluable source of creativity and a much-needed dose of escapism, reading has not only kept many of us sane in times of crisis but has also served to remind us of our shared humanity. Like every other industry, however, the publishing world is coming to terms with a changed operating environment, new physical limitations, and novel challenges. It is a tale that has some way to run yet, but one that has bibliophiles turning the pages anxiously, desperately hoping for a happy ending.

News

Three people, including the driver and a conductor, have died after a passenger train derailed near Stonehaven, in Aberdeenshire. The train, travelling from Aberdeen to Glasgow, is thought to have hit a landslide, after heavy rain and thunderstorms caused flooding and travel disruption across Scotland.

An Imperial College antibody home testing programme has revealed that up to six per cent of England's population – nearly 3.5 million people - may have been infected with Covid-19 by the middle of July. The world’s largest home testing programme also suggested significant regional divergences, with a total of 13% of people living in London having Covid-19 antibodies, compared with less than three per cent in the south-west of England.

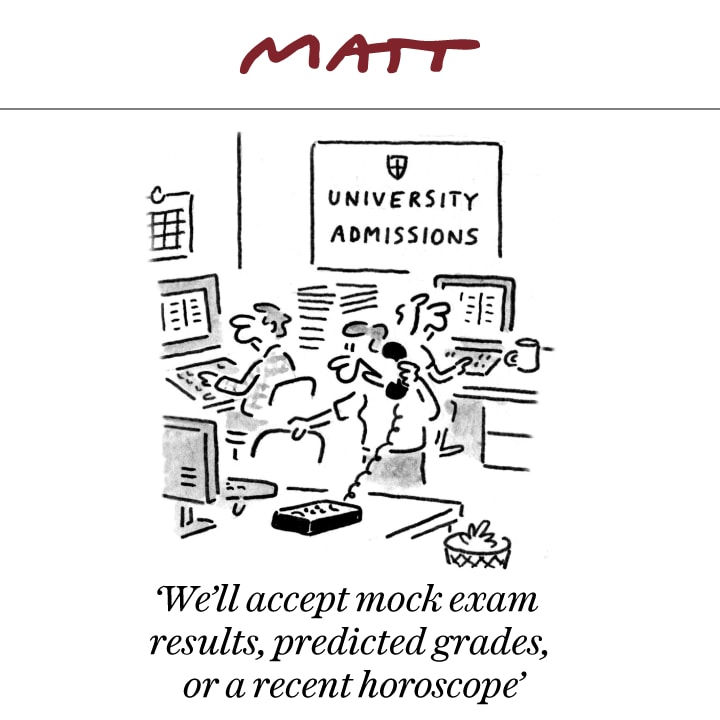

A-level and vocational results are being published for almost 300,000 students across England, Wales and Northern Ireland, amid growing frustration caused by the late changes to the exam results system. In England, the government has assured students that it will apply a “triple lock” to ensure students who feel the estimated grade received today is unfair will have a chance to appeal that via their school or college, either by using a previous mock exam result, or siting another exam in the autumn. The head of one teaching union said the move “beggars belief” and completely misunderstands how mock exams work.

Business and economy

City business leaders have called for deeper tax relief after the UK economy entered recession as GDP plunged by a record 20.4% between April and June, the biggest single quarter decline on record. As coronavirus lockdowns hammered activity in April, vast swathes of the economy closed, before bouncing back 8.7% in June.

Think-tank Resolution Foundation predicts big house price falls across the UK over the next 12 months but says that tighter credit conditions and falling incomes will hamper buyers’ efforts to get on to property ladder. (£)

UK restaurants and bars have announced a further boost from the government’s discount eating-out scheme in its second week, but reported trade on other days is suffering as many customers are spending less. Operators continue to remain cautious, cutting some traditional promotions and raising service charges in spite of an increase in sales. (£)

Columns of note

Writing in The Guardian, Afua Hirsch explores further the current state of the UK arts industry. She argues that in order to survive and thrive again, the sector needs to broaden its gaze and confront the remnants of a still sovereign colonial narrative within the industry.

In the Financial Times, Sarah Gordon addresses an issue of growing concern – a global surge in domestic violence. The silver lining, she writes, is that that policymakers’ response is changing for the better as more academic research is building on the effectiveness of intervention. (£)

Source: Telegraph

Markets

What happened yesterday?

US stocks briefly surpassed the all-time closing high reached before the coronavirus pandemic as shares of major tech companies recovered some of their steep losses from the previous session. The S&P 500 Index jumped 1.4% to 3,380.35, the highest in about six months. The Nasdaq Composite Index and The Dow Jones Industrial Average also rose sharply at 2.13% and 1.05% respectively. In Europe, stocks closed higher as investors continued to bet on an impending economic recovery from the coronavirus crisis. London's FTSE 100 ended the session up at 2.04% following signs of a recovery in economic output in June and the FTSE 250 was 0.51% firmer at 18,089.58. In terms of bonds, the yield on 10-year treasuries climbed two basis points to 0.66%, the highest in more than five weeks while Britain’s 10-year yield gained four basis points to 0.237%, the highest in almost eight weeks. On the currency markets, the pound ended down 0.01% against the dollar to $103047, losing 0.49% on the euro to €1.1061. Copper climbed 0.2% to $2.88 a pound and gold slightly changed at $1,911.27 an ounce. On the currency markets, the pound was down 0.15% against the dollar at $1.31 and edged down 0.13% against the euro at €1.11. In company news:

Online fashion retailer ASOS has increased its sales forecast for the year ahead, reporting an increase in full year pre-tax profit to £80 million amidst growing demand. The London-based online food order and delivery service Just Eat Takeaway.com's stock price rose 3.2% to 102.46 after reporting higher revenues and underlying profit for the first half of 2020. The European food-ordering firm posted EBITDA of 177 million euros, a 44% year-on-year increase. NatWest is cutting at least 550 jobs across its retail business and will close a major London office as it battles to cut costs during the Covid-19 crisis. China’s Lenovo Group reported a better-than-expected 31% jump in quarterly profits and said it is capturing opportunities emerging from remote working.

What's happening today?

Finals

Renishaw

Watches Switz

Interims

Anexo Group Plc

Empiric

GVC Holdings

Helios Towers

National Express

Tribal Grp

Trading announcements

Pennant International

Watches Switz

UK economic announcements

(00:01) RICS Housing Market Survey

Int. economic announcements

(07:00) Consumer Price Index (GER)

(13:30) Continuing Claims (US)

(13:30) Initial Jobless Claims (US)

(13:30) Import and Export Price Indices

Did you know?

Cherophobia is an irrational fear of fun or happiness.

Parliamentary highlights

House of Commons

In recess until 1 September 2020

House of Lords

In recess until 2 September 2020

Scottish Parliament

Portfolio questions

Finance; Environment, Climate Change and Land Reform; Rural Economy and Tourism.

Comments