- Charlotte Street Partners

- May 21, 2020

- 4 min read

Central bank independence

Written by Juan Palenzuela, Associate

Edited by David Gaffney, Partner

Good morning,

Until now, central bankers have had an aura of technical expertise that sometimes sets them apart from other state institutions. Instead of following the political moods of their nations, Western central banks have remained strongly committed to maintaining monetary stability and inspiring confidence in the population.

Pressure is nothing new for them. Controlling monetary policy gives them a lot of power and no less responsibility. And despite attempts from some political leaders to influence their decision making, the banks have remained fiercely independent in most of the wealthy world. But that seems to be changing.

Earlier this month, Germany’s Constitutional Court accused the European Central Bank of failing to adequately justify its quantitative easing program. While the programme was somewhat polemic, it nonetheless started years ago, in 2015, and the points made by the court are arcane at best.

Unlike Treasuries, which are in charge of taxing and spending and, in a way, act from above the action, central banks are on the field of play, inside the market. Legitimacy for their independence rests on the assumption that there is an inverse relationship between unemployment and inflation.

But in recent years, that relationship appears to be disappearing. Up until Covid-19 struck, most OECD countries enjoyed record low employment and tame rates of inflation. Many believe that it was the result of low inflation expectations, but a more likely cause, in my opinion, is falling investments and the resulting secular stagnation.

The consequences of central banks losing their independence would be felt far beyond their own countries. Most certainly, it would hurt free trade.

With governments controlling monetary policy, the incentive would be to maintain low interest rates, which increases the money supply and, in turn, depreciates the currency’s value, thus making exports more competitive internationally. That would certainly risk adding to an already challenging backdrop at a time when the WTO is effectively dead, protectionism is rising and borders are stiffening.

News

US president Donald Trump announced yesterday that he may seek a face-to-face meeting for the G7 Washington summit which will take place in June, after earlier cancelling the gathering due to the pandemic. It would be a sign of a comeback, the president tweeted.

Domestic holidays within the UK could be permitted as early as the beginning of July, the culture secretary Oliver Dowden announced yesterday. The announcement came after Patricia Yates, chief executive of VisitBritain, warned on Tuesday that the sector expected to lose £37bn from the impact of Covid-19.

Scotland’s first minister Nicola Sturgeon is set to announce a new four-phase roadmap for easing restrictions today during her daily update. Figures published yesterday showed that Scotland's Covid-19 death rate had fallen for the third week in a row.

Business and economy

Andrew Bailey, governor of the Bank of England, told MPs that it would be “foolish” to rule out negative interest rates at this stage. The comments came after the Treasury’s debt management office sold a government bond with a negative yield for the first time in its history.

Venezuela filed a $1bn lawsuit against the Bank of England over its refusal to release gold stashed in its vaults, as the South American government scrambles for funds to alleviate the deepening economic and health crisis affecting the country. Britain does not recognise the government of Nicolas Maduro as legitimate.

Warren East, Rolls-Royce chief executive, announced yesterday that the company would slash at least 9,000 jobs on top of the 1,000 previously announced. That will equate to around 17% of its global workforce, but the backlash will be felt in particular by Britain’s civil aerospace business, which accounts for 16,000 employees.

Columns of note

Writing for the Financial Times, Simon Kuper argues that social media is helping us pay tribute to ordinary lives, by separating each Covid-19 case out from the statistical barrage into an individual tragedy. This also has political consequences, he argues.

Also in the Financial Times, Martin Sandbu says that the Eurozone’s bailout funds have so far remained accessible, and member states should put their concerns aside and reap its advantages while they last.

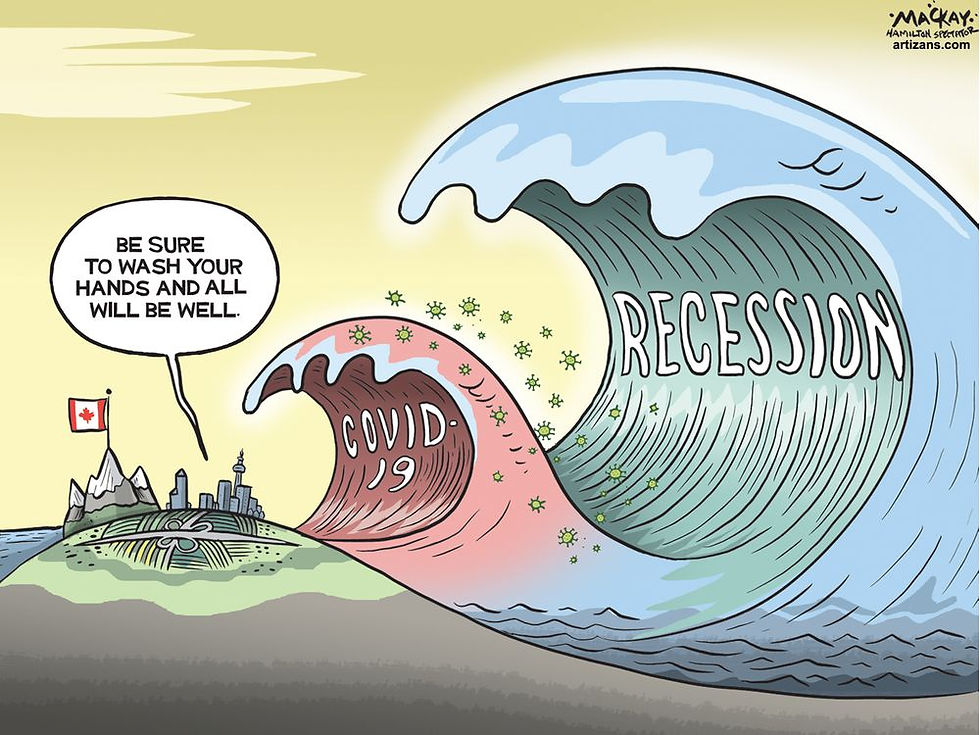

Source: The Calgary Herald

Markets

What happened yesterday?

Global equity markets had mixed fortunes yesterday. In the US, the Dow Jones Industrial Average finished up 1.52% at 24,575.90, while the S&P 500 was 1.67% firmer at 2,971.61 and the Nasdaq Composite saw out the session 2.08% stronger at 9,375.78.

In Britain, stocks also edged higher with the FTSE 100 up 1.08% at 6,087.16, alongside a 0.29% rise on the second-tier index to 16,367.48.

Stocks in Asia lagged, however, as concerns over the impact of the coronavirus on global trade outweighed the prospect of fresh support from central banks.

On Thursday, Japan’s benchmark Topix index fell 0.1 per cent while China’s CSI 300 of Shanghai- and Shenzhen-listed stocks rose 0.1 per cent and Hong Kong’s Hang Seng index was flat.

In company announcements, M&S released its full year results. The retailer reported that pre-tax profit fell to £403m from £511m the previous year. It said that the pandemic had directly hit its profits by £52m and added £212.8m in costs and write-downs.

Compass Group, meanwhile, announced plans to raise £2bn to help it survive the impact of the pandemic, in the largest equity fundraising in the UK since the crisis began.

What's happening today?

Finals Finals

Mediclinic

Pets At Home

Shield Thera

System1 Group

Tate & Lyle

Universe Grp.

Interims

Euromoney Inst.

Intgrafin Hldg

Oxford Metrics

Tharisa

Trading announcements

Essentra

Intertek Group

Kingfisher

Regional Reit

Annual report

Sumo Group

Int. Economic Announcements

(13:30) Initial Jobless Claims (US)

(13:30) Continuing Claims (US)

Source: FTSE 100, Financial Times

Did you know?

The earliest record of a named cat is from over 3400 years in Egypt, his name was "Nedjem" which means sweet or pleasant.

Parliamentary highlights

House of Commons

No business scheduled

House of Lords

Oral questions

Update to the guidance given to hospitals about ensuring the safety of patients who do not have COVID-19 who require life-saving emergency treatment - virtual proceeding - Baroness Browning

Publication of government proposals for the roll out of the UK Shared Prosperity Fund - virtual proceeding - Lord Teverson

Changes in global oil markets and the implications of those changes for trade, climate change, and international security - virtual proceeding - Lord Howell of Guildford

Supporting the increasing number of people claiming benefits for unemployment - Baroness Sherlock

Debate

Contribution made by businesses and the wider private sector in addressing the COVID-19 pandemic - virtual proceeding - Lord Dobbs

Scottish Parliament

First minister statement

Members’ Question Time

Local Government and Communities

Parliamentary bureau motions

Comments